Selling your Company.

We sell your company

Selling your company is the biggest, most important, and most challenging “deal” you will ever make. It involves the successful continuation of your life's work, job security and employee confidence, and - a lot of money. It is also a transaction in which, in the interests of internal confidentiality, you may have to act without the involvement of trusted advisors within the company. And it is a transaction that will confront you with measures and decisions that you have not had to deal with before.

If you want to tackle the issue of selling your company and are doing so for the first time, you should have an experienced M&A advisor at your side.We have successfully advised clients in Düsseldorf and Cologne!

Spezialist für Unternehmensverkauf

We are happy to assist you with these challenges and provide you with professional support. We look forward to getting to know you in a non-binding meeting—wherever and however suits you best.- at our premises in Stuttgart

- at your premises

- via Teams meeting or

- by telephone

Corporate transactions are structured and, when managed professionally, transparent processes. Nevertheless, they are not a simple matter! Legal, tax, and interpersonal pitfalls and shoals, for example within the family or among shareholders, must be avoided.

SengColl. is committed to finding the right buyer for you, achieving the best possible purchase price, and ensuring that your company continues to prosper after the sale.We provide successful consulting services in Düsseldorf and Cologne!

Selling your company: M&A Advisory

What you ask yourself as a company seller.

- Why should I consider selling my business? I'm still young, and I enjoy my work.

- Do I know today whether one of my children can or wants to continue the business?

- Are there any buyers for my business at all? And if so, which one is the right one and how can I identify them?

- Would right now be the right time to sell?

- I have high price expectations and don't believe anyone will pay them.

- If my sales are not so good at the moment, wouldn't now be a bad time?

- What will happen to my employees?

- How will my customers react?

- Why is my tax advisor advising me against a sale?

- What determines a good purchase price?

- How much of the purchase price will I have left after taxes?

- How long does such a sale take and how will it affect my day-to-day business?

- How can I prevent my intention to sell from becoming public knowledge?

- Will a buyer continue to run my company in line with my vision?

- I have heard from two colleagues who have had bad experiences.

- What do they want to know during due diligence and how long does it take?

- If I do sell, I want to be out immediately. Is that possible?

- How much will all this cost me?

These and many other questions are asked by entrepreneurs who are thinking about succession or considering taking on an investment in order to obtain equity capital, the necessary know-how, sales synergies, etc. SengColl. has an individual answer to each of these questions that is appropriate for the respective situation.

An important part of this is the disclosure of all facts (situation: sales, costs, employees, orders, debts, etc.) prior to the sale: due diligence!We sell your company profitably through our buyer network!

The M&A Market.

Searching buyers for your company

The many medium-sized, often family-run companies in the German-speaking countries are under pressure. In addition to the already difficult economic environment, there is accelerated technological change, the requirements of digitalization, and the resulting, usually high, investment needs. At the same time, capital is seeking investment opportunities on an unprecedented and still growing scale, especially in private equity. As a result, the processes surrounding mergers and acquisitions, which were previously treated rather secretly, have become an open business topic. Today, medium-sized entrepreneurs recognize the enormous potential for shaping their businesses: from raising equity capital, minimizing risk, and achieving synergy effects to selling the company with a return participation.

However, this increased popularity has significantly changed the M&A market, its conventions, and its players. The prospect of high brokerage commissions tempts many, often unqualified “business brokers” to make a quick buck.

Instead of structured processes, quick internet searches are carried out, mailings and email campaigns are sent out, and unsolicited calls are made to entrepreneurs, luring them with attractive deals and high purchase prices.

But the growth in popularity has significantly changed the M&A market and its conventions. The prospect of high brokerage commissions tempts many, often barely qualified newcomers to make quick money as brokers. Instead of structured processes, quick internet searches are carried out and mass mailings, emails, and unsolicited calls are made to entrepreneurs promising attractive M&A deals and high purchase prices. There is hardly an entrepreneur who is not regularly harassed in this way.

But quantity usually lacks quality. This is because an entrepreneur's life's work is put at risk when it is scattered across the internet as an object for sale, placed in “deal factories,” and presented to other brokers and random buyers. The special confidentiality of the matter is usually handled casually.

This approach is not appropriate when addressing medium-sized companies. The quality of M&A consulting must match the level of the company!

Industrial strategists, private equity firms, and family offices as buyers of SMEs are professionals. They can tell from the very first contact whether a seller is poorly advised or not advised at all. Both can cost the seller a lot of money!

When should I sell my business?"

The right time.

As with a share, the value of a company is based on its past and future economic performance. The best time to sell is therefore when a company is making good profits, the order books are full, and years of economic boom are ahead. However, what entrepreneur would not find it difficult to think about selling at such a time? Who would not want to take these future profits?

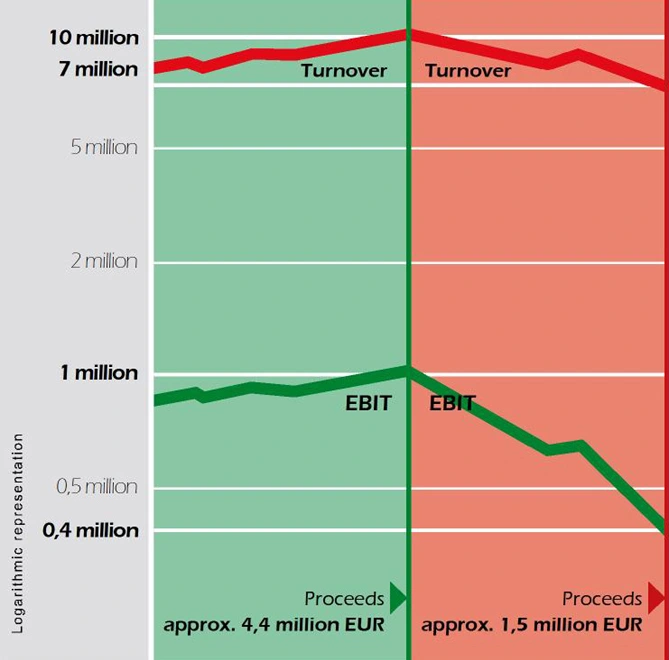

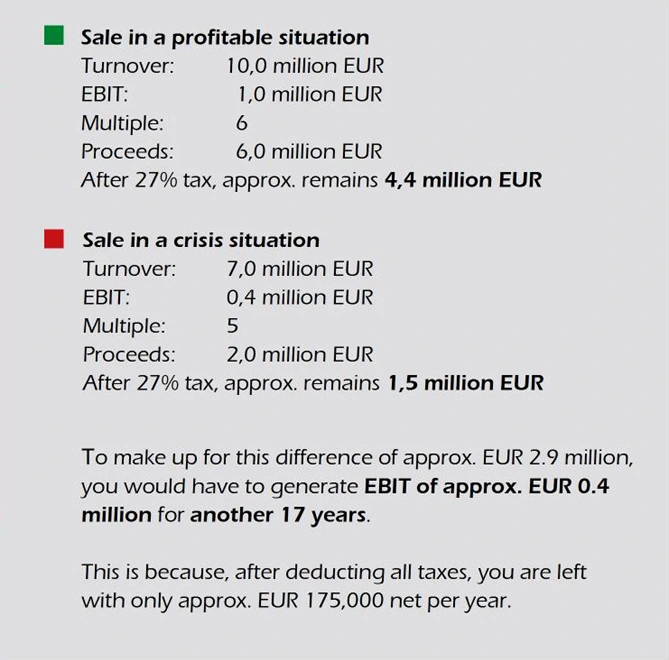

The following example shows how the net sale price achievable for a seller can plummet dramatically when the industry's economy and thus the company's earnings are in decline.

If sales fall by 30 percent, the EBIT achieved usually falls even more sharply, e.g., by 60 percent. And with it, the multiple used by buyers as the basis for their valuation. As shown below, as a shareholder and entrepreneur over the age of 56, you would have to continue to run your company successfully for many years to compensate for this financial disadvantage in net terms.Selling companies in Düsseldorf and Cologne!

Selling your company: Transactions

The transactions phases.

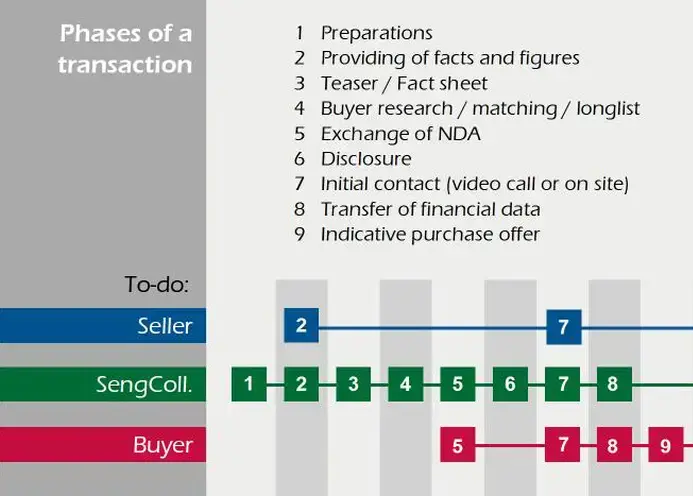

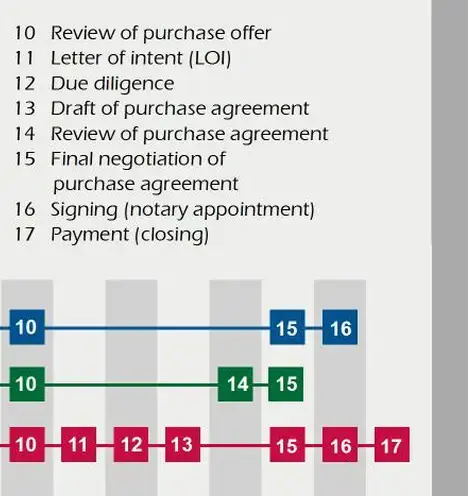

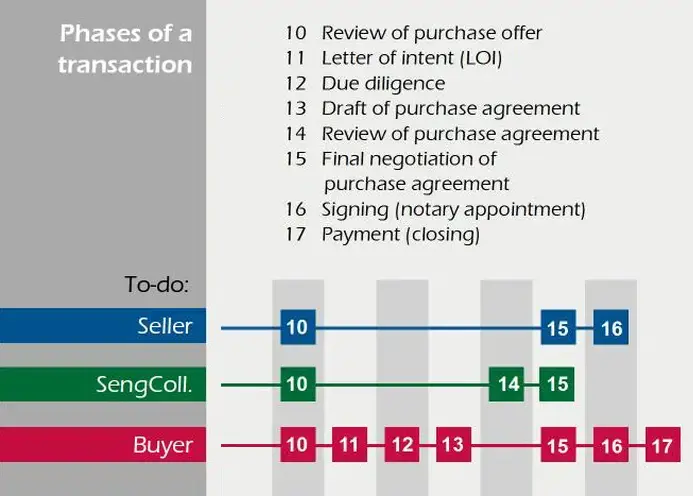

Regardless of the size of

a company stake, corporate transactions go through defined phases that are

managed and organized by SengColl. in such a way that the sales process leads

you to the expected success in the shortest possible time and without any problems.

As the seller, you will of

course be kept informed of the current status at all times, but will only be

involved in operational matters when necessary. The chart below shows which

tasks should be performed by you or by a person you have entrusted with the

matter during the transaction.

Selling your company: The Purchase Price

The Purchase Price.

SengColl does not try to“sell” you an expensive company valuation. The value of a company is the result of an assessment based on current and past figures. The actual achievable purchase price, based solely on the principle of supply and demand, is the reality. However, if you disclose your figures to us, we will give you an expected purchase price range.

However, the purchase price is not only based on annual financial statements, but also on facts such as strengths, weaknesses, opportunities, and risks, and, last but not least, on unique selling points.

Since buyers are investing in the future of your company and the purchase price must be amortized through future profits, we use our “potential analysis” chart to show buyers the strengths and potential of their company.

SengColl. ensures the continuity of your life's work and the financial security of your future with the right buyer.

Payment of the Purchase Price

- Earn-out: If your purchase price expectations are based too heavily on future profits, the buyer will initially pay a base purchase price based on current and past figures. In addition, an earn-out will be agreed. This means that if the forecast profits are realized, the buyer will make one or more additional payments.

- Seller loan: If your preferred prospective buyer is unable to provide the necessary financing for the acquisition of your company, you can enable them to take over the company by granting them a seller loan.

- Reinvestment: If you still hold minority shares for a defined period of time and want to participate in the expected positive development, there is the option of reinvestment. This allows you to participate in the increase in value of your company realized by the buyer even after the sale. For their part, the buyer welcomes your re-participation as proof that you are convinced of the successful future of the sold company.

- Company value vs. purchase price: The company value is the result of a valuation based on current and past figures. The actual achievable purchase price, based solely on the principle of supply and demand, is the reality.

Strategies selling your company

M&A strategies.

Buyer strategies for the company

Acquisitions in the German-speaking region are special! This German-speaking area, with its proverbial SMEs, is characterized not only by long-standing, established customer relationships and the high regional reputation of its companies, but also by high regulatory standards. A long-term corporate strategy is therefore crucial for the successful acquisition of an SME, as future corporate goals must be aligned with current corporate and market parameters. Buyer strategies are multi-layered and complex, and either vertically or horizontally oriented.Seaching for buyers: Vertical acquisition strategy

Vertical Acquisition Strategy.

The aim here is to integrate a company that is active outside the buyer's industry but within its value chain. For example, by acquiring a niche supplier from its own supply chain or a service provider in order to be able to offer after-sales services.

The objectives here are, for example

- Greater vertical integration

- Access to market niches

- Gain in know-how

- Improved quality control

- Increased efficiency and reduced costs

- Improved margins

- Stronger position vis-à-vis own customersn

Seaching for buyers: Horizontal acquisition strategy

Horizontal Akquisition Strategy.

This aims to acquire a company in the same industry, often a competitor.

The objectives here are, for example

- Growth and expansion

- Increasing market share

- Brand strategy

- Acquisition of qualified employees

- Access to technology

- Cross-border expertise and access to international markets

- Diversification of the service portfolio

- Acquisition of new customer relationships

Selling your company: The integration

Post-Merger-Integration.

In order to successfully implement an acquisition strategy, it must be planned in advance of a takeover.

This includes:

- Clear communication with all stakeholdersr

- Timely involvement of key employeesr

- Sensitive cultural integration in international transactions

- Maintaining customer loyalty, especially with key accounts

- Implementing operational synergies in parallel with ongoing operations